Are these three barriers holding you back from starting your own business?

HOME / / Are these three barriers holding you back from starting your own business?

What’s holding you back?

Here are three common barriers holding entrepreneurs back from starting up… and how you can get past them.

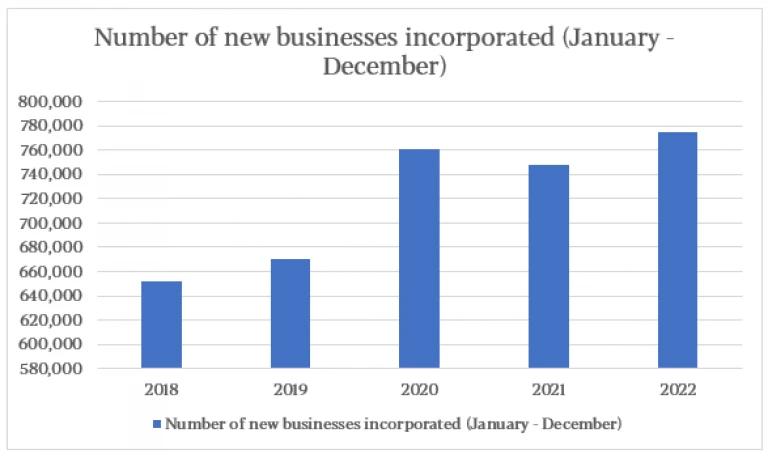

After a surge in startups during COVID, the number of new business formations grew again in 2022.

Data from Companies House shows 774,420 new businesses were registered between 1 January – 31 December 2022, a 3.5% increase on the 2021 figures. According to this analysis, that total is also 19% higher than five years ago.

The slowdown in 2021 was probably not surprising after everything the UK went through in the pandemic and the uncertain economic environment.

After more than a decade of supporting UK-based businesses, we're keen to keep exploring what the barriers are for UK entrepreneurs, and find ways to help you get over them or around them. These seem to be the three biggies...

1. Confidence

Previous Start Up Loans surveys suggest that the number of potential business owners would be significantly higher if UK entrepreneurs had more confidence and access to resources (both financial and knowledge-based).

Back in 2016, over half of the people questioned in a survey by One Poll said they’d like to start their own company, but 60% of them said they fear that their self-employment ambitions will only ever be a dream.

A more recent study conducted in 2020 found that a lack of confidence is holding back 41% of people from starting their own business.

We know that despite our findings that now is a great time to be your own boss, leaving a secure, full-time job to start a business on your own can be daunting. As a result, only a fraction of the people who have the entrepreneurial ambition to start a business ever see their plans come to fruition.

Start Up Loans found that the fear of failure (10.50%) and the associated risks of setting up alone (11.25%) were some of the most common reasons holding people back. But if you read this article by Transmit Startups co-founder Damian Baetens on Fighting the Fear Factor, you'll discover that the key to succeeding is to prepare well before you begin in order to minimise the risks. Preparing for success is something Smarta are offering entrepreneurs for free.

Any attempt to learn by trial and error is bound to involve some failure. And those lacking confidence might understandably see learning by doing in approach entrepreneurship as a risky approach. So how about taking a free online training course, guided by business experts, at your own pace?

2. Funding and financials

British Business Bank's 2016 study found financial-related risks and uncertainty to be the second biggest barrier to those considering starting a business. This included being the main salary earner and the risk of failing and losing this stream of income (13.30%) as well as not having the funds to start up (12.45%), fear of being unable to pay bills (7.30%), lack of savings (6.30%) and worries about handling tax and "red tape" (3.15%).

In the 2020 research by WebsiteToolTester, almost half (46%) of those surveyed said they would need over £20,000 to start a new business.

The good news

On 25 September 2022, the Business Secretary Jacob Rees-Mogg announced the expansion of the Start Up Loans scheme for new businesses, delivering much-needed finance to the UK’s startups.

Since it began in 2012, The Start Up Loans programme has provided more than 95,000 loans to start-ups across the UK.

Businesses trading for up to 3 years can apply for a Start Up Loan (previously it was up from 2 years).

Start Up Loans provide a fixed interest rate of 6% for entrepreneurs borrowing between £500 and £25,000. Applicants are provided with mentoring and business support which makes it possible for those who might struggle to a loan from a traditional lender to be your own boss.

The widening of the eligibility criteria means that 33,000 new loans will be available, and Second Loans will be available to businesses who've been trading for up to 5 years.

3. Knowledge and resources

In The British Business Bank's Business Dreamers Survey, almost one in ten people indicated that access to more resources would be gratefully received. 7.20% felt that they had a lack of knowledge and experience which meant they felt unable to go it alone, while 2.50% stated that they had their business idea ready to go, but just didn’t know where to start.

Do you dream of starting your own business… but don’t know where to start?

We've put together a structured six week learning programme to guide you through the process of preparing to start your business. It's called Six to Start and was created specifically for people just like you, who want to understand just how to get themselves up and running and do things right first time.

You can choose whether you'd like to receive:

six weekly emails, to guide you through completing your first business plan without overloading you with info

OR

everything all at once, in an ebook you can download and work through entirely at your own pace.

Simply visit this page, scroll down to the bottom and enter your email address to receive free guides, hints and expertise from our team of business advisors.

Lack of time, family commitments and having no one to turn to for advice were found to be relatively uncommon barriers (2.50%, 2.25% and 0.20% respectively).

Of course, the above fears and uncertainties are barriers that most of the entrepreneurs we have supported have faced at one time or another. It’s because of this experience that we can not only relate, but that we know they can be overcome and those with ambitions can make their business dreams become a reality.

How to run a business outside of business hours

If you’re juggling full or part-time employment with a passion project or side hustle, we’ve been in your shoes.

So, we’ve come up with a short, sharp list of smart ideas to help you achieve the seemingly impossible.

The Business Dreamers survey highlighted the top reasons people set up their own business:

1. Flexibility (working hours, working location) – 24.15%

2. Being your own boss – 22.40%

3. Potential earnings – 12.20%

4. Self-achievement – 6.65%

5. The opportunity to pursue your hobby as your business – 6.00%

Team Transmit have been asking ourselves "What is startup spirit?" We think the recipe is a delicious mixture of optimism, opportunism and growth mindset - best served with generous helpings of support.

"We’re delighted to be the 2000th loan recipients!"