5 ways to tackle stress as an entrepreneur

HOME / / 5 ways to tackle stress as an entrepreneur

So you quit your job to start a business of your own?

Congratulations! We know what a huge step this is.

Leaving behind a job that provides a regular and reliable income, a pension contribution and other employee benefits can be daunting. But you may also have left behind a fixed working pattern and a To Do List that wasn't in your control. And that can be a huge relief.

Since you'll now rely on the success of your own business to pay the bills and keep a roof over your head, you're going to face a different kind of stress. You may also find that you end up working more hours when you're the boss.

According to data reported on Statista.com, as of December 2022, approximately 38.5% of self-employed people in the United Kingdom worked between 31 and 45 hours a week. Just over a fifth worked more than 45 hours.

Start Up Loans customer Victoria Nichol is the star of one of our Transmit Startups Sucess Stories. Victoria says:

"It's funny, when you start your own business you end up working harder for your own clients and team than you ever did for someone else!

Especially when you're trying to build a reputation, hire talent, deliver great work for your clients and develop more business and that same ethos across your team. You have to work hard but it’s worth it to make a positive difference and be recognised for that."

Having stability, security, and the ability to create that for yourself is very empowering.

Putting in long hours, combined with the pressure of trying to turn a profit can test your personal resilience.

If one of the biggest sources of stress for you is working out how to finance your startup, that's something we can help with.

From free startup business advice whilst you consider your options and affordable business finance to fund your startup, and step-by-step business guides to get you up-and-running.

When you start working with us, our expert business advisers are on hand with business planning templates to help you write a business plan and apply for a Start Up Loan.

Identify the Triggers

Before you can know how to alleviate your stress levels, it’s important to first understand where they come from.

No doubt some of your stresses are from things within your control (like choosing a business bank account), while others might be completely out of your control (like changes to business rates you'll have to pay if you rent premises).

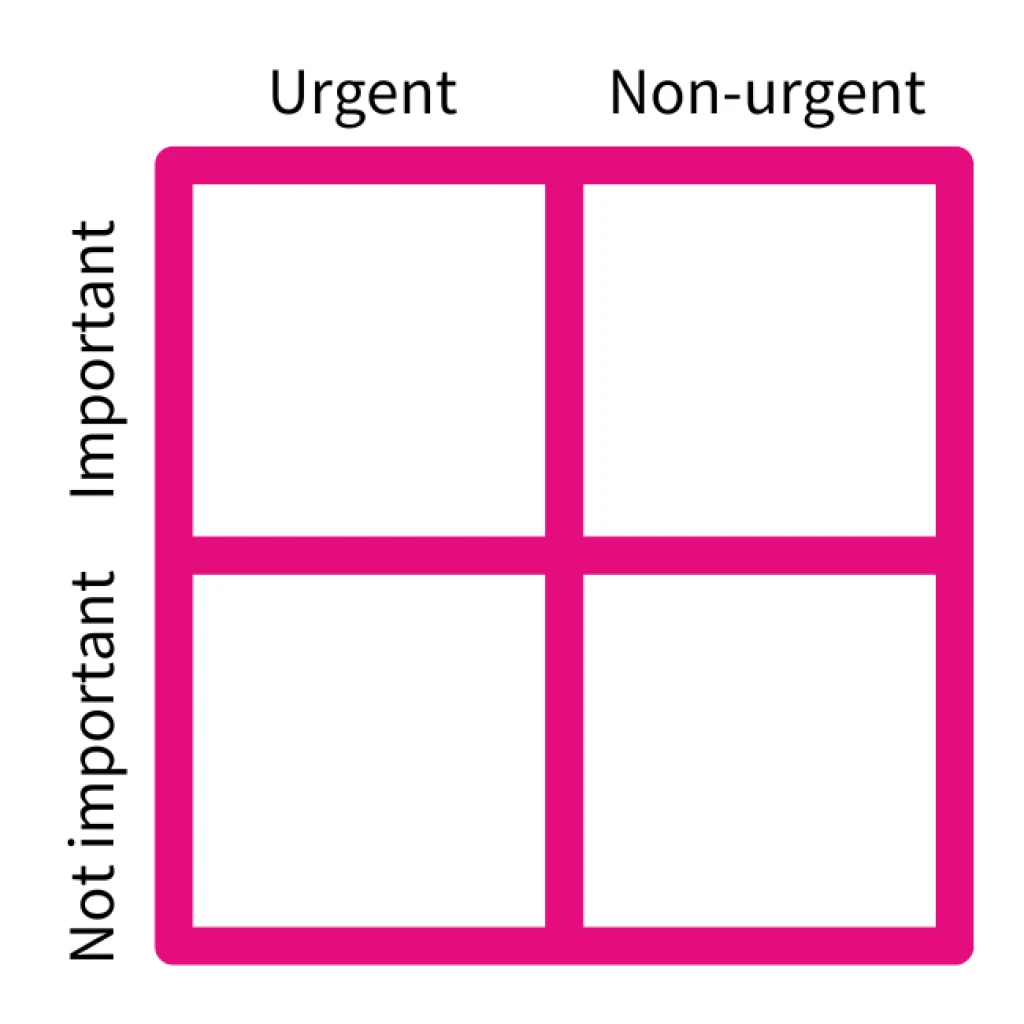

Some stresses arise out of the minutia of work and life – small things on your to-do list that you know you need to tackle (pretty urgent, but not that important in the scheme of things). Other worries stem from your long-term personal and professional goals (important, but not particularly urgent).

Before you start problem-solving: make a grid

List out your worries and stresses under these four headings and consider which of the five tips below could help to alleviate each type of stress.

Whichever aspect of business ownership is winding you up, here are five tips to tackle it

Tip 1. Seek support

Transitioning to the life of an entrepreneur can be extremely lonely at times – particularly in the early stages.

All entrepreneurs believe 100% in their own vision and it can be tempting to fall into the trap of trying to do absolutely everything yourself, but there’s a lot to be said for the phrase "a problem shared is a problem halved".

Seeking advice, support or even just a friendly face who understands your challenges can make everything feel more manageable and help you feel connected to the small business community. Here's how:

Sign up for local networking events (don't worry if you're not an experienced networker, this resource can help)

Get yourself a business mentor or coach, either by using your growing network or by searching on LinkedIn

In another Success Story, bookshop founder Emma told us how much she values the informal support from her network.

"My designer, Denise, who I met on a career change coaching course. I really love my suppliers as well. I have this amazing supplier of hot chocolate... whenever I order something, she always sends me a little note to ask how I'm getting on and asked how the shop is doing.

There's a woman who has a few independent bookshops in the North East, she's been amazing with advice.

I feel cradled by these people.

Although it's not formal support, I feel like I have this network of people who are interested in the success of the business and care about what we're doing. I know that if I got stuck, there's people I could ask."

Whatever your challenges, there are people out there that can give you invaluable advice, help to alleviate stress and ultimately support you to grow your business. You just need to be open-minded and proactive in your approach to finding them.

Tip 2. Take time away from your desk

It's easy to get stuck in a vicious cycle where you're so focused on the everyday running of your business that you never get the headspace to consider the bigger picture.

This is a trap that keeps many businesses from growing to their full potential as your time is taken up with stressing over the day-to-day details, not the things that can actually take your business to the next level.

If you don’t take the time out, then nothing will ever change.

Attending an event, seminar, webinar, workshop or simply having a relaxed ‘business development day’ in a coffee shop instead of stuck behind your desk can make a world of difference.

You might meet new people, get new ideas and hopefully – return to work with a long-term plan for your business that will help you overcome both short-term and long-term stresses by giving you a renewed focus.

Tip 3. Tackle financial woes head-on

If cash flow or a lack of funds to grow your business is stressing you out, then don’t bury your head in the sand! The worst thing you can do when it comes to money worries is to ignore them – as this is a problem that can exponentially get worse when it’s left unchallenged.

Review your accounts (or ask an accountant to review them for you) so that you have a clear understanding of your financial situation. Even if you know it’s bad – you need to know just how bad it is.

Once you’re clear on this, you can begin to look at what options are available. Are there grants? Loans? Investment opportunities? Partnership opportunities?

Get in touch with a professional that can properly (and without bias) guide you as to what solutions can quickly get you and your business back on track. Trust us – you will feel instantly better once you have a plan to address this.

Tip 4. Set boundaries

Yes, those that are self-employed do work longer hours on average than most others, but not having a 9-5 job is no reason to feel as though you have to work 24/7.

Set yourself some reasonable time boundaries that could conceivably work for your business. Remember, you’re not doing yourself or your business any favours by working all hours. You need to build a sustainable business that can physically be run by employees that won’t match your hours – so keep that in mind.

We love this quote from best-selling author Greg McKeown:

"Are you protecting your greatest asset?

In the noise of everyday life, it can be easy to forget that you are the asset of your life, and you must protect that asset.

There are constant demands on our time and energy. There is pressure to compete and compare ourselves with others. We worry about missing out on opportunities.

For just a moment, I want to cut through all this clutter to remind you that you are the asset.

And none of the good things you do, none of your essential pursuits are possible if you do not protect and prioritize your well-being."

Tip 5. Revise your plan

Having a solid and structured business plan will help you to feel much less stressed. If your current stress levels are so high that they're causing real concern for your physical and mental health, your business goals may need to be adjusted in the short-term to give you chance to recover. When your business' greatest asset (you!) is back on form, take a fresh look at your financial forecasts and marketing plans, and set some achievable targets.

Learning how the principles of organisational resilience can be applied to small businesses will help you outline your weaknesses and vulnerabilities. When you anticipate the bigger challenges, they'll cause you far less stress.

"We’re delighted to be the 2000th loan recipients!"